As any furniture or homewares operator knows, the real P&L story of Black Friday only reveals itself weeks later, when the reverse-logistics tide rolls in. And 2025’s tide looks strong.

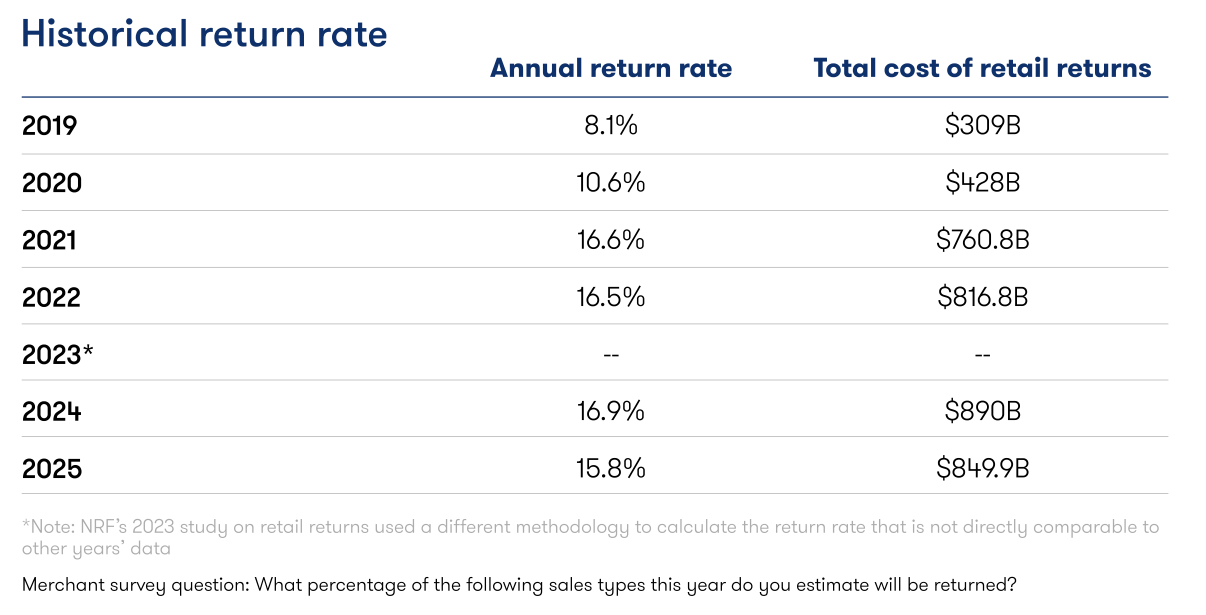

Industry-wide, returns remain enormous: According to the National Retail Federation (NRF), US retailers expect roughly 15.8% of annual sales to come back this year (about $850bn of merchandise) with holiday return rates materially higher than the yearly average. Translation: peak trading amplifies the problem, not the other way round.

And the first big swell typically hits the week after Cyber Monday. UK returns specialists report that the Monday/Tuesday a week after Cyber Monday tends to be one of the highest return-volume moments of the year, with another wave in early January. If you felt great yesterday, keep your nerve: the next two weeks are where margins are won or lost.

What’s different in furniture this year

Our upcoming December study (sign up below for early access) highlights a behaviour shift that should worry every furniture brand:

-

50% of 1,500 consumers say they’d “order now and decide later” on returning furniture items (rising to ~60% for Gen Z).

-

The top non-damage reasons for returns are painfully familiar: “didn’t fit through the door,” “wrong size for the space,” and “looked different from the product photo.”

-

Between 15% and a third of furniture/home items bought online are being returned for aesthetic/fit reasons.

That’s not just frustrating; it’s a direct threat to peak season profitability. It mirrors the broader retail environment where return costs have become headline-level: UK estimates from Parcelhub put 2024 returns at ~£27bn, and many retailers have already started tightening policies or adding fees to stem the bleed.

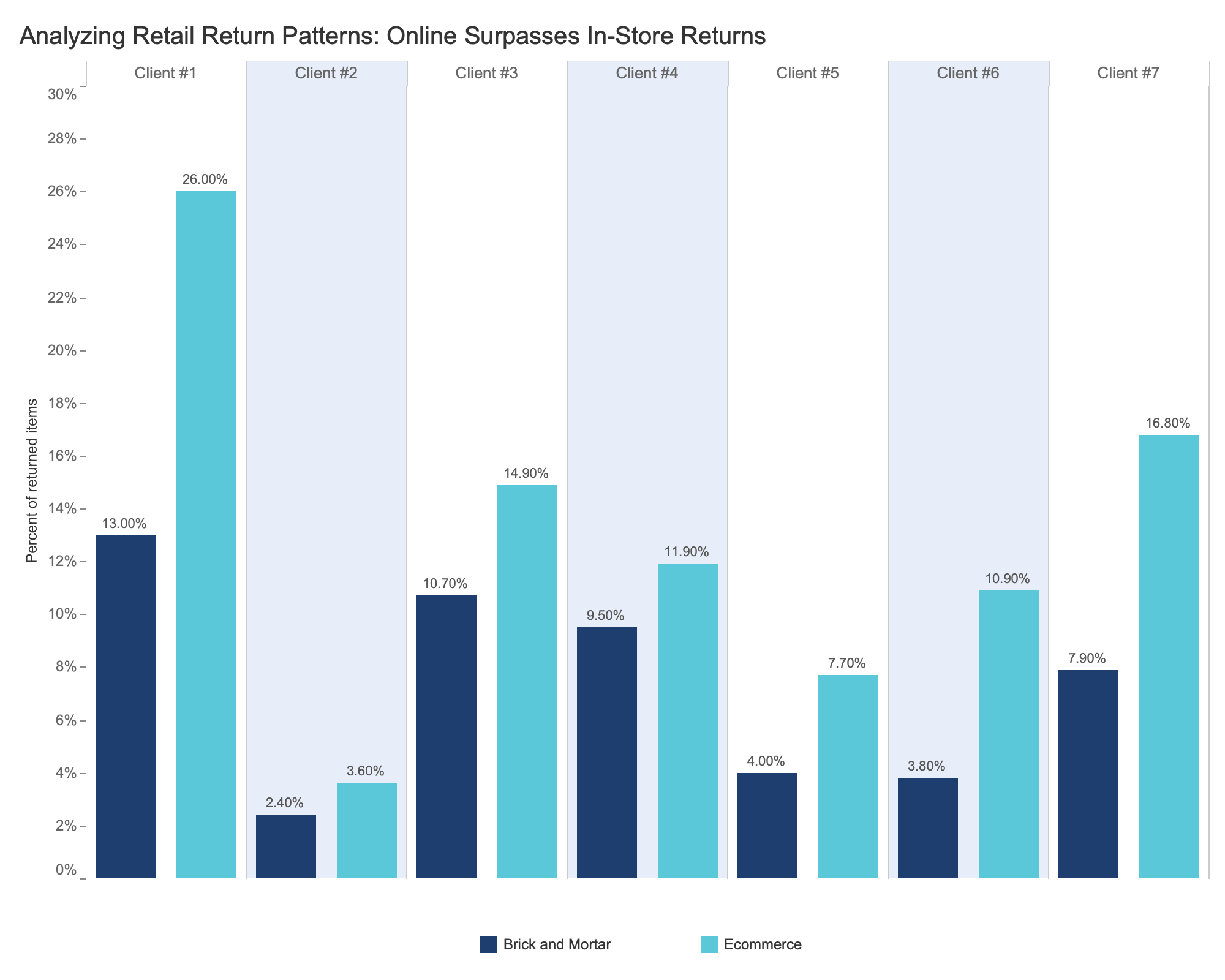

The graph above shows retail return patterns between e-Commerce and in-store purchases, courtesy of Appriss Retail.

Returns can erase great sales quickly

Public company disclosures and trading updates have been clear about the impact of returns on profits in recent years. One UK exec put it plainly: Boohoo CEO John Lyttle noted returns running 4 - 6 percentage points above pre-pandemic levels as customer habits shifted, showing an uptick that contributed to repeated margin pressure and outlook resets. When a fast-moving retailer feels that pain, it’s a reminder that the unit economics of returns can overwhelm top-line wins if left unchecked.

Furniture has an extra handicap: reverse logistics for bulky items is expensive, operationally messy, and stock often can’t be resold as new. Even when you win the initial order, the wrong order costs you twice (collection expenses, refurbishment/write-down, and the lost chance to sell the right product the first time).

The good news: better visualization reduces returns

There’s a reliable pattern in the data: when shoppers can properly see and test products digitally, they return less.

-

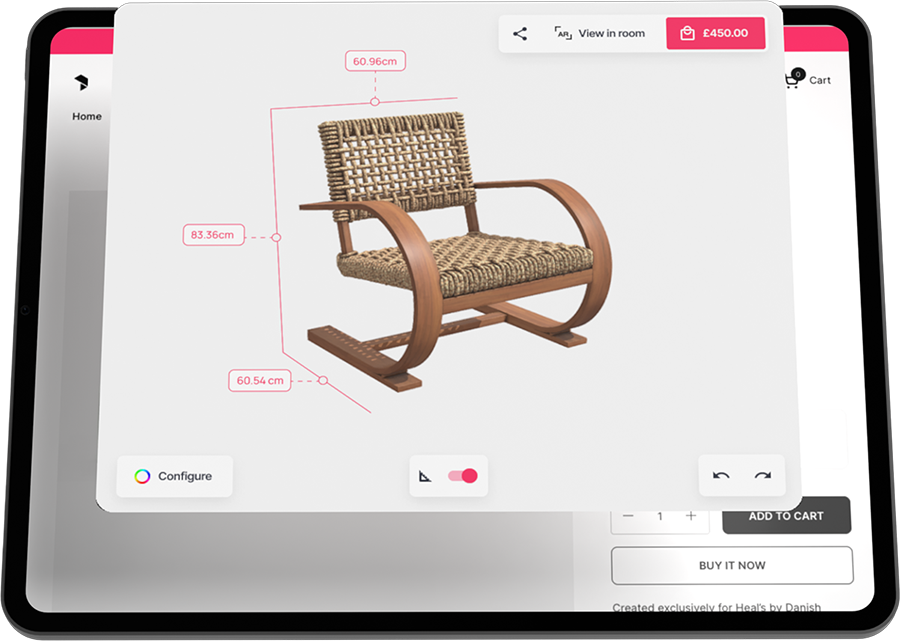

70% of 100 furniture retail leaders across the US and UK in a 2025 survey stated that 3D and AR technologies were reducing product returns.

-

Shopify case studies show 3D/AR product media delivering a 5% reduction in returns alongside order conversion lifts, specifically because buyers can validate fit and scale before they buy.

-

Returns specialists consistently flag post-peak surges, reinforcing the case for interventions that de-risk the choice upfront, such as 360° spins to room-scale AR.

This is precisely where furniture and bathroom categories can outperform. The biggest reasons consumers return (fit, scale, style mismatch) are one of the reasons immersive visualization exists.

A practical playbook for the next 6–8 weeks

Even if your Black Friday was strong, the post-purchase experience you enable today can protect December–January margins.

-

Fix fit and flow before checkout

Embed room-scale AR “View in Room” on PDPs so shoppers can validate doorways, corridors, and final placement. Add dimension callouts inline with 3D and AR viewers (height, width, depth, clearance). If you sell modular sofas or bathroom suites, enable multi-product placement or 3D room visualisers so customers can see how elements work together.

-

Stop “looks different from the photo”

Replace static imagery with 360° spins and/or zoomable 3D models so textiles, grains, and finishes are visible under varied lighting and angles. It answers the “will it really look like that?” objection which, in our research, heavily drives returns.

-

Let shoppers configure the right thing

Offer 3D configurators for colorways, leg styles, hardware, and bundle components. When buyers assemble the product they actually want, they return it less.

-

Bring bathrooms to life

Bathrooms are high-stakes, high-return risk. Let customers lay out full suites in a browser-based room planner, swap finishes, and check clearances for doors, drawers, and traffic flow. This addresses the “too big for the space” and “doesn’t work together” returns at the source.

-

Monitor post-Black-Friday return signals daily

ZigZag Global trends tell us the week after Cyber Monday is a danger zone. Use that as your checkpoint for PDP tweaks, FAQ clarifications, and size/fit education. A few changes can shave points off the return curve before January.

For boards and CFOs: the ROI case

Preventing even a 3 to 5 percentage-point slice of returns at peak trading season typically pays for 3D/AR tooling and model creation many times over, especially in bulky categories with high reverse-logistics costs and write-downs.

And the macro story supports the urgency. The NRF’s 2025 outlook pegs returns at $849.9bn (15.8% of sales) and notes holiday rates run meaningfully higher. (See image above taken from the NRF's 2025 Retail Returns Landscape). Many retailers are now tightening policies or adding return fees (a reactionary strategy, but also a visible cost to the customer that can depress conversion). It’s far better, therefore, to remove uncertainty up-front so you can keep both the sale and the goodwill.

P.S. It's focussed on fast fashion, however a recent 2025 survey from ZigZag Global has come out, based on August 2025 research data, with some interesting insights into returns culture too and so thought I'd share here too for further reading: https://info.zigzag.global/annual-returns-report-2025

A note on our December research (early access)

Our fresh study on furniture returns drops in December 2025, covering order-now-decide-later behaviour, Gen Z differences, and the aesthetic/fit drivers behind returns.

Want the early copy? Click the button below and submit your email.

Are aesthetic returns eating into your margins?

For more information on how Fixtuur can help your retail business integrate these cutting-edge 3D technologies speak to one of our experts.